How Greece Became A Guinea Pig For A Cashless And Controlled Society

As Greece moves closer to becoming a cashless society, it is clear that the country’s attitude towards cash is reckless and dangerous. The supposed convenience of switching to a cash-free system comes with a great deal of risk, including needless overreach by the state.

MICHAEL NEVRADAKIS

ATHENS (Analysis) – Day by day, we’re moving towards a brave new world where every transaction is tracked, every purchase is recorded, the habits and preferences of everyone noted and analyzed. What I am describing is the “cashless society,” where plastic and electronic money are king, while banknotes and coins are abolished.

“Progress” is, after all, deemed to be a great thing. In a recent discussion, I observed on an online message board regarding gentrification in my former neighborhood of residence in Queens, New York, the closure of yet another longtime local business was met by one user with a virtual shrug: “Who needs stores when you have Amazon?”

This last quote is, of course, indicative of the bricks-and-mortar store, at least in its familiar form. In December 2016, Amazon launched a checkout-free convenience store in Seattle—largely free of employees, but also free of cash transactions, as purchases are automatically charged to one’s Amazon account. “Progress” is therefore cast as the abolition of currency, and the elimination of even more jobs, all in the name of technological progress and the “convenience” of saving a few minutes of waiting at the checkout counter.

Still insist on being old-fashioned and stuck behind the times, preferring to visit bricks-and-mortar stores and paying in cash? You may very well be a terrorist! Pay for your coffee or your visit to an internet cafe with cash? Potential terrorist, according to the FBI. Indeed, insisting on paying with cash is, according to the United States Department of Homeland Security, “suspicious and weird.”

Still insist on being old-fashioned and stuck behind the times, preferring to visit bricks-and-mortar stores and paying in cash? You may very well be a terrorist! Pay for your coffee or your visit to an internet cafe with cash? Potential terrorist, according to the FBI. Indeed, insisting on paying with cash is, according to the United States Department of Homeland Security, “suspicious and weird.”

The European Union, ever a force for positive change and progress, also seems to agree. The non-elected European Commission’s “Inception Impact Assessment” warns that the anonymity of cash transactions facilitates “money laundering” and “terrorist financing activities.” This point of view is shared by such economists as the thoroughly discredited proponent of austerity Kenneth Rogoff, Lawrence Summer (a famed deregulator, as well as eulogizer of the “godfather” of austerity Milton Friedman), and supposed anti-austerity crusader Joseph Stiglitz, who told fawning participants at the World Economic Forum in Davos earlier this year that the United States should do away with all currency.

Logically, of course, the next step is to punish law-abiding citizens for the actions of a very small criminal population and for the failures of law enforcement to curb such activities. The EU plans to accomplish this through the exploration of upper limits on cash payments, while it has already taken the step of abolishing the 500-euro banknote.

The International Monetary Fund (IMF), which day after day is busy “saving” economically suffering countries such as Greece, also happens to agree with this brave  new worldview. In a working paper titled “The Macroeconomics of De-Cashing,” which the IMF claims does not necessarily represent its official views, the fund nevertheless provides a blueprint with which governments around the world could begin to phase out cash. This process would commence with “initial and largely uncontested steps” (such as the phasing out of large-denomination bills or the placement of upper limits on cash transactions). This process would then be furthered largely by the private sector, providing cashless payment options for people’s “convenience,” rather than risk popular objections to policy-led decashing. The IMF, which certainly has a sterling track record of sticking up for the poor and vulnerable in society, comforts us by saying that these policies should be implemented in ways that would augment “economic and social benefits.”

new worldview. In a working paper titled “The Macroeconomics of De-Cashing,” which the IMF claims does not necessarily represent its official views, the fund nevertheless provides a blueprint with which governments around the world could begin to phase out cash. This process would commence with “initial and largely uncontested steps” (such as the phasing out of large-denomination bills or the placement of upper limits on cash transactions). This process would then be furthered largely by the private sector, providing cashless payment options for people’s “convenience,” rather than risk popular objections to policy-led decashing. The IMF, which certainly has a sterling track record of sticking up for the poor and vulnerable in society, comforts us by saying that these policies should be implemented in ways that would augment “economic and social benefits.”

The IMF’s Greek experiment in austerity

These suggestions, which of course the IMF does not necessarily officially agree with, have already begun to be implemented to a significant extent in the IMF debt colony known officially as Greece, where the IMF has been implementing “socially fair and just” austerity policies since 2010, which have resulted, during this period, in a GDP decline of over 25 percent, unemployment levels exceeding 28 percent, repeated cuts to what are now poverty-level salaries and pensions, and a “brain drain” of over 500,000 people—largely young and university-educated—migrating out of Greece.

Protesters against new austerity measures hold a placard depicting Labour Minister George Katrougalos as the movie character Edward Scissorhands during a protest outside Zappeion Hall in Athens, Friday, Sept. 16, 2016. The placard reads in Greek ”Katrougalos Scissorhands”.

Indeed, it could be said that Greece is being used as a guinea pig not just for a grand neoliberal experiment in both austerity, but de-cashing as well. The examples are many, and they have found fertile ground in a country whose populace remains shell-shocked by eight years of economic depression. A new law that came into effect on January 1 incentivizes going cashless by setting a minimum threshold of spending at least 10 percent of one’s income via credit, debit, or prepaid card in order to attain a somewhat higher tax-free threshold.

Beginning July 27, dozens of categories of businesses in Greece will be required to install aptly-acronymized “POS” (point-of-sale) card readers and to accept payments by card. Businesses are also required to post a notice, typically by the entrance or point of sale, stating whether card payments are accepted or not. Another new piece of legislation, in effect as of June 1, requires salaries to be paid via direct electronic transfers to bank accounts. Furthermore, cash transactions of over 500 euros have been outlawed.

In Greece where, in the eyes of the state, citizens are guilty even if proven innocent, capital controls have been implemented preventing ATM cash withdrawals of over 840 euros every two weeks. These capital controls, in varying forms, have been in place for two years with no end in sight, choking small businesses that are already suffering.

Citizens have, at various times, been asked to collect every last receipt of their expenditures, in order to prove their income and expenses—otherwise, tax evasion is assumed, just as ownership of a car (even if

purchased a decade or two ago) or an apartment (even if inherited) is considered proof of wealth and a “hidden income” that is not being declared. The “heroic” former Finance Minister Yanis Varoufakis (pictured) had previously proposed a cap of cash transactions at 50 or 70 euros on Greek islands that are popular tourist destinations, while also putting forth an asinine plan to hire tourists to work as “tax snitches,” reporting businesses that “evade taxes” by not providing receipts even for the smallest transactions.

purchased a decade or two ago) or an apartment (even if inherited) is considered proof of wealth and a “hidden income” that is not being declared. The “heroic” former Finance Minister Yanis Varoufakis (pictured) had previously proposed a cap of cash transactions at 50 or 70 euros on Greek islands that are popular tourist destinations, while also putting forth an asinine plan to hire tourists to work as “tax snitches,” reporting businesses that “evade taxes” by not providing receipts even for the smallest transactions.

All of these measures, of course, are for the Greeks’ own good and are in the best interest of the country and its economy, combating supposedly rampant “tax evasion” (while letting the biggest tax evaders off the hook), fighting the “black market” (over selling cheese pies without issuing a receipt, apparently), and of course, nipping “terrorism” in the bud.

As with the previous discussion I observed about Amazon being a satisfactory replacement for the endangered bricks-and-mortar business, one learns a lot from observing everyday conversations amongst ordinary citizens. A recent conversation I personally overheard while paying a bill at a public utility revealed just how successful the initial and largely uncontested steps enacted in Greece have been.

In the line ahead of me, an elderly man announced that he was paying his water bill by debit card, “in order to build towards the tax-free threshold.” When it was suggested to him that the true purpose of encouraging cashless payments was to track every transaction, even for a stick of gum, and to transfer all money into the banking system, he and one other elderly gentleman threw a fit, claiming “there is no other way to combat tax evasion.”

The irony that they were paying by card to avoid taxation themselves was lost on them—as is the fact that the otherwise fiscally responsible Germany, whose government never misses an opportunity to lecture the “spendthrift” and “irresponsible” Greeks, has the largest black market in Europe (exceeding 100 billion euros annually), ranks first in Europe in financial fraud, is the eighth-largest tax haven worldwide, and one of the top tax-evading countries in Europe.

Also lost on these otherwise elderly gentlemen was a fact not included in the official propaganda campaign: Germans happen to love their cash, as evidenced by the fierce opposition that met a government plan to outlaw cash payments of 5,000 euros or more. In addition, about 80 percent of transactions in Germany are still conducted in cash. The German tabloid Bild went as far as to publish an op-ed titled “Hands off our cash” in response to the proposed measure.

Global powers jumping on cashless bandwagon

Nevertheless, a host of other countries across Europe and worldwide have shunned Germany’s example, instead siding with the IMF and Stiglitz. India, one of the most cash-reliant countries on earth, recently eliminated 86 percent of its currency practically overnight, with the claimed goal, of course, of targeting terrorism and the “black market.” The real objective of this secretly planned measure, however, was to starve the economy of cash and to drive citizens to electronic payments by default.

Indians stand in line to deposit discontinued notes in a bank in Jammu and Kashmir, India,, Dec. 30, 2016. India yanked most of its currency bills from circulation without warning on Nov. 8, delivering a jolt to the country’s high-performing economy and leaving countless citizens scrambling for cash. (AP/Channi Anand)

Iceland, a country that stands as an admirable example of standing up to the IMF-global banking cartel in terms of its response to the country’s financial meltdown of 2008, nevertheless has long embraced cashlessness. Practically all transactions, even the most minute, are conducted electronically, while “progressive” tourists extol the benefits of not being inconvenienced by the many seconds it would take to withdraw funds from an ATM or exchange currency upon arrival. Oddly enough, Iceland was already largely cashless prior to its financial collapse in 2008—proving that this move towards “progress” did nothing to prevent an economic meltdown or to stop its perpetrators: the very same banks being entrusted with nearly all of the money supply.

Other examples of cashlessness abound in Europe. Cash transactions in Sweden represent just 3 percent of the national economy, and most banks no longer hold banknotes. Similarly, many Norwegian banks no longer issue cash, while the country’s largest bank, DNB, has called upon the public to cease using cash. Denmark has announced a goal of eliminating banknotes by 2030. Belgium has introduced a 3,000-euro limit on cash transactions and 93 percent of transactions are cashless. In France, the respective percentage is 92 percent, and cash transactions have been limited to 1,000 euros, just as in Spain. Outside of Europe, cash is being eliminated even in countries such as Somalia and Kenya, while South Korea—itself no stranger to IMF intervention in its economy—has, similarly to Greece, implemented preferential tax policies for consumers who make payments using cards.

Other examples of cashlessness abound in Europe. Cash transactions in Sweden represent just 3 percent of the national economy, and most banks no longer hold banknotes. Similarly, many Norwegian banks no longer issue cash, while the country’s largest bank, DNB, has called upon the public to cease using cash. Denmark has announced a goal of eliminating banknotes by 2030. Belgium has introduced a 3,000-euro limit on cash transactions and 93 percent of transactions are cashless. In France, the respective percentage is 92 percent, and cash transactions have been limited to 1,000 euros, just as in Spain. Outside of Europe, cash is being eliminated even in countries such as Somalia and Kenya, while South Korea—itself no stranger to IMF intervention in its economy—has, similarly to Greece, implemented preferential tax policies for consumers who make payments using cards.

Aside from policy changes, practical everyday examples also exist in abundance. Just try to purchase an airline ticket with cash, for instance. It remains possible—but is also said to raise red flags. In many cases, renting an automobile or booking a hotel room with cash is simply not possible. The aforementioned Department of Homeland Security manual considers any payment with cash to be “suspicious behavior”—as one clearly has something to hide if they do not wish to be tracked via electronic payment methods. Ownership of gold makes the list of suspicious activities as well.

Just as the irony of Germany being a largely cash-based society while pushing cashless policies in its Greek protectorate is lost on many Greeks, what is lost on seemingly almost everyone is this: something that is new doesn’t necessarily represent progress, nor does something different. Something that is seemingly easier, or more convenient, is not necessarily progress either. But for many, “technological progress,” just like “scientific innovation” in all its forms and without exception, has attained an aura of infallibility, revered with religious-like fervor.

People queue in front of a bank for an ATM as a man lies on the ground begging for change, in Athens. (AP/Thanassis Stavrakis)

Combating purported tax evasion is also treated with a religious-like fervor, even while ordinary citizens—such as the two aforementioned gentlemen in Greece—typically seek to minimize their outlays to the tax offices. Moreover, while such measures essentially enact a collective punishment regardless of guilt or innocence, corporations and oligarchs who utilize tax loopholes and offshore havens go unpunished and are wholly unaffected by a switch to a cashless economy in the supposed battle against tax evasion.

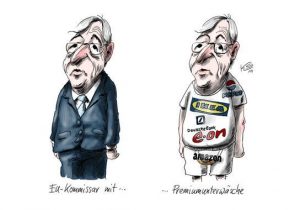

This is evident, for instance, in the case of “LuxLeaks,” which revealed the names of dozens of corporations benefiting from favorable tax rulings and tax avoidance schemes in Luxembourg, one of the original founding members of the EU. European Commission President Jean-Claude Juncker (pictured in the cartoon),  formerly the prime minister of Luxembourg, has faced repeated accusations of impeding EU investigations into corporate tax avoidance scandals during his 18-year term as prime minister. Juncker has defended Luxembourg’s tax arrangements as legal.

formerly the prime minister of Luxembourg, has faced repeated accusations of impeding EU investigations into corporate tax avoidance scandals during his 18-year term as prime minister. Juncker has defended Luxembourg’s tax arrangements as legal.

At the same time, Juncker has shown no qualms in criticizing Apple’s tax avoidance deal in Ireland as “illegal,” while having been accused himself of helping large multinationals such as Amazon and Pepsi avoid taxes. Moreover, he has openly claimed that Greece’s Ottoman roots are responsible for modern-day tax evasion in the country. He has not hesitated to unabashedly intervene in Greek electoral contests, calling on Greeks to avoid the “wrong outcome” in the January 2015 elections (where the supposedly anti-austerity SYRIZA, which has since proven to be boldly pro-austerity, were elected).

He also urged the Greek electorate to vote “yes” (in favor of more EU-proposed austerity) in the July 2015 referendum—where the overwhelming result in favor of “no” was itself overturned by SYRIZA within a matter of days. In the European Union today, if there’s something that can be counted on, it’s the blatant hypocrisy of its leaders. Nevertheless, proving that old habits of collaborationism die hard in Greece, the rector of the law school of the state-owned Aristotle University in Thessaloniki awarded Juncker with an honorary doctorate for his contribution to European political and legal values.

Cashless policies bode poorly for the future

Where does all this lead though? What does a cashless economy actually mean and why are global elites pushing so fervently for it? Consider the following: in a cashless economy without coins or banknotes, every transaction is tracked. Buying and spending habits are monitored, and it is not unheard of for credit card companies to cancel an individual’s credit or to lower their credit rating based on real or perceived risks ranging from shopping at discount stores to purchasing alcoholic beverages. Indeed, this is understood to be common practice. Other players are entering the game too: in late May, Google announced plans to track credit and debit card transactions.

Claudia Lombana, PayPal’s shopping specialist, stamps a guest’s passport as he visits the travel section of PayPal’s Cashless Utopia in New York (Victoria Will/AP)

More to the point though, a cashless economy doesn’t just mean that financial institutions, large corporations, or the state itself can monitor all transactions that are occurring. It also means that the entirety of the money supply—itself now existing only in “virtual” form—will belong to the banking system. Not one cent will exist outside of the banking system, as physical currency will simply not be in circulation. The banking system—and others—will be aware not just of every transaction, but will be in possession of all of our society’s money supply, and will even have the ability to receive a percentage of every transaction that is taking place.

So what happens if your spending habits or your choice of travel destinations raises “red flags”? What happens if you run into hard times economically and miss a few payments? What happens if you are deemed to be a political dissident or liability – perhaps an “enemy of the state”? Freezing a bank account or confiscating funds from accounts can take place almost instantaneously. Users of eBay and PayPal, for instance, are quite aware of the ease with which PayPal can confiscate funds from a user’s account based simply on a claim filed against that individual.

Simply forgetting one’s password to an online account can set off an aggravating flurry of calls in order to prove that your money is your own—and that’s without considering the risks of phishing and of online databases being compromised. Many responsible credit card holders found that their credit cards were suddenly canceled in the aftermath of the “Great Recession” simply due to perceived risk. And if you happen to be an individual deemed to be “dangerous,” you can be effectively and easily frozen out of the economy.

Those thinking that the “cashless revolution” will also herald the return of old-style bartering and other communal economic schemes might also wish to reconsider that line of thinking. In the United States, for instance, bartering transactions are considered taxable by the Internal Revenue Service. As more and more economic activity of all sorts takes place online, the tax collector will have an easier time detecting such activity. Thinking of teaching your child to be responsible with finances? That too will have a cost, as even lemonade stands have been targeted for “operating without a permit.” It’s not far-fetched to imagine that particularly overzealous government authorities could also target such activity for “tax evasion.”

In Greece, while oligarchs get to shift their money to offshore tax havens without repercussion and former Finance Minister Gikas Hardouvelis has been acquitted for failure to submit a declaration of assets, where major television and radio stations operate with impunity without a valid license while no new players can enter the marketplace, and where ordinary households and small businesses are literally being taxed to death, police in August 2016 arrested a father of three with an unemployed spouse for selling donuts without a license and fined him 5,000 euros. In another incident, an elderly man selling roasted chestnuts in Thessaloniki was surrounded by 15 police officers and arrested for operating without a license.

Amidst this blatant hypocrisy, governments and financial institutions love electronic money for another reason, aside from the sheer control that it affords them. Studies, including one conducted by the American Psychological Association, have shown that paying with plastic (or, by extension, other non-physical forms of payment) encourage greater spending, as the psychological sensation of a loss when making a payment is disconnected from the actual act of purchasing or conducting a transaction.

But ultimately, the elephant in the room is whether the banking system even should be entrusted with the entirety of the monetary supply. The past decade has seen the financial collapse of 2008, the crumbling of financial institutions such as Lehman Brothers in the United States  and a continent-wide banking crisis in Europe, which was the true objective behind the “bailouts” of countries such as Greece—saving European and American banks exposed to “toxic” bonds from these nations. Italy’s banking system is currently teetering on dangerous ground, while the Greek banking system, already recapitalized three times since the onset of the country’s economic crisis, may need yet another taxpayer-funded recapitalization. Even the virtual elimination of cash in Iceland did not prevent the country’s banking meltdown in 2008.

and a continent-wide banking crisis in Europe, which was the true objective behind the “bailouts” of countries such as Greece—saving European and American banks exposed to “toxic” bonds from these nations. Italy’s banking system is currently teetering on dangerous ground, while the Greek banking system, already recapitalized three times since the onset of the country’s economic crisis, may need yet another taxpayer-funded recapitalization. Even the virtual elimination of cash in Iceland did not prevent the country’s banking meltdown in 2008.

Should we entrust the entirety of the money supply to these institutions? What happens if the banking system experiences another systemic failure? Who do you trust more: yourself or institutions that have proven to be wholly irresponsible and unaccountable in their actions? The answer to that question should help guide the debate as to whether society should go cashless.

************

ER recommends other articles by MintPress News