The Beginning Of The End Of Sovereignty? Europe Launches First “Socially-Targeted Bonds”

“Yeah, sure they are environmentally friendly.. says so on the plastic wrapper.”

The glorious march forward of the correct thinking European superstate takes another great leap forward this morning with the launch of the first socially targeted bonds under the most intelligently designed SURE programme. All credit to the diligent double-plus-good Eurocrats of Brussels for their foresight in launching this epoch defining issue!

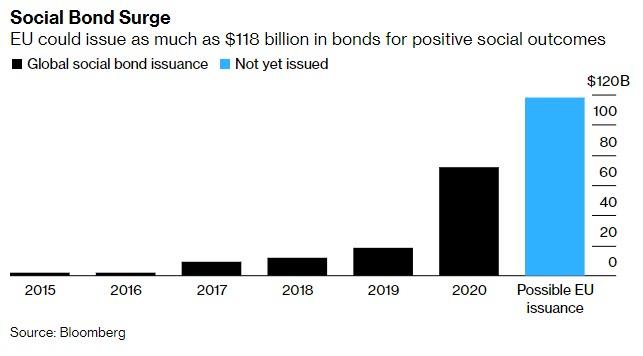

The EU will issue its first 10 and 20-year SURE bonds this morning. Officially the €100 bln programme is to finance “the social needs of EU Member States following the coronavirus pandemic and its consequences.” The SURE Programme is part of a larger €750 bln Recovery bond binge cooked up between the EU and ECB to solve Europe’s growth issues in the wake of the virus. The SURE Programme will run till the Recovery Bonds kick in next year, with over 200 bln issuance expected.

[Zerohedge: As Bloomberg reports, social bonds are defined by funding for projects that help society, such as improving social welfare or serving disadvantaged populations. They are the “perfect financial response” to the shock that welfare systems experienced from the pandemic, according to a report by Maia Godemer, a research analyst for green and sustainable finance at BNEF.]

Whoopee.

I shall avoid obvious cynicism… but… it’s difficult to keep a straight face at the way these bonds are being marketed as “social bonds” by the EU and its bankers to smokescreen what they really achieve.

Today’s bonds will be priced with a negative yield, but investors will lap them up because they are slightly less of a negative yield than Bunds, and they expect the EU bonds will tighten in price as the ECB drives European rates ever lower into the sub-zero zone to create the recovery and inflation that has thus far eluded them. (A policy that has achieved nothing the last 5 years.. but, hey, keep trying…)

“I was expecting a three-digit book but not quite this high,” said Jan von Gerich, chief strategist at Nordea Bank Abp.

“These bonds were clearly eagerly awaited, and these issues only strengthen the picture that there is a huge demand for bonds at the moment.”

More to the point, this afternoon investors will be able to sell the bonds in the secondary market back to the ECB, probably at a small profit because of oversubscription, via its QE infinity programmes. The 5 investment banks leading the sale – which curiously includes Barclays, a bank domiciled on Airstrip1theUK – will be delighted to be sharing about €20 mm in fees.

Meanwhile.. back in Frankfurt (the not-quite-the-centre of European finance the Germans imagine it to be) lone EU critic, Bundesbanker Jens Weidemann, is desperately saying any EU joint-borrowing should be one-off, and should not become a common budgetary tool. Sadly…. No one is listening, Jens. He is a lone voice in the Frankfurt wilderness.. No one is listening.

Too late. Common issuance looks inevitable. Today’s bonds establish a clear pathway towards a single European Bond Issuance vehicle, allowing AAA/Aaa/AAA rated Europe to dominate global issuance and for Brussels to set the funding agenda.

ECB Head Christine Lagarde wants joint issuance to be part of her armoury. While Jens points out that much “closer political integration would be needed and for the EU to develop into a democratic state” before common bond issuance is even contemplated, the reality is it’s happened. This bond redefines and strengthens the role of Brussels’ unelected Eurocrats in terms of financial power. This bond completes the state-capture of European national financing by Brussels. There will still be Bunds, Bonos, BTPs and OATs… for a while… for a while..

Weidemann and the Germans had this curious notion that when countries joined the Eurozone, they meet the strict membership rules of the Euro by exercising sound fiscal responsibility, reforming their economies, and ensuring solid accountable finances. Silly Germans.

What this programme achieves is the centralisation of European finance despite the absence of any real democratic process or agreement on a European polity. Instead, the ECB and Brussels will decide. They have captured the system. European states will no longer go to the market to raise Euros to bulwark unemployment or stem job losses – nope, now they apply to Brussel for handouts. No longer will they need to finance much needed projects via markets in their own name – Brussels now runs their budgets.

The new EU funding programmes fit perfectly with the rules of Euro membership – independent nations can’t run up large state deficits under the terms of the Euro, but client states beholden to Brussels just need to ask nicely.

Of course, you won’t find Brussels’ capture of national finances clearly stated on the bond prospectus or sales pitch this morning. Nope. Instead we have a very complex and convoluted smokescreen as the EU focuses the attention of the market and the market press on these bonds being sold to the world as a Social Bond Programme.

WTF?

It’s deflection and distraction. I read through the issue pitch and there are lots of reassuring objective phrases like “spirit of solidarity”, “preserving productive capacity” and “mitigating direct societal and economic impact”, which I am sure are very laudable goals, but if anyone can explain this one, I am all ears:

“The SURE instrument can be seen as an emergency operationalisation of the European Unemployment Reinsurance Scheme announced by the President of the European Commission in her Political Guidelines.”

Thank you, Chairman Leyen, for your political wisdom….

It goes on to assure potential investors the bonds meet ICMA Social Bond Principles – even appointing an external party to opine they are aligned with ICMA! The pitch conclusively says these are suitable as ESG investments. I know what you are thinking… Can these bonds get any better?

To ensure investors are satisfied the bond proceeds are being used for the designated social purposes, there will be regular reports (imposed by article 13(2) of the SURE regulation relating to the implementation of the planned public expenditure..) I can’t wait to read these reports – it will be fascinating to hear how the EU traces, say, the €504 mm it’s just given to Bulgaria under the programme. I wonder if they will do it as effectively as they’ve traced the billions skimmed off grants and aid programmes by Italian gangsters under previous aid programmes?

And just in case you are confused by the jargon, the EU helpfully explains:

“It is EU’s ambition to align future EU bonds with the forthcoming EU Taxonomy for environmentally sustainable activities. To avoid any confusion, the bonds under the present Framework will be named “EU SURE Social Bonds”: they are not prefiguring the social part of the future EU Taxonomy nor a possible action of the Commission in the area of the EU Green/Social Bond Standard.”

I simply can’t wait… for the EU to institute their next programme: Governance bonds! These will lend EU cash directly to European companies that do exactly what Brussels tells them to do. (US readers: dripping Sarcasm alert.)

Now, in case you are wondering – no, these bonds are not joint and severally guaranteed by European Community member states… but they are guaranteed by €25 mm voluntarily contributed by member states.. Don’t ask how that works, but the EU is AAA rated.. so what’s the problem…? and the ECB will buy them.

Actually.. if you have any questions on the bonds… they can all easily be answered: The ECB will buy them. What’s to worry? Buy the bonds. Pay the EU 26 basis points per annum for the privilege of owning them and what can possibly go wrong when the ECB will buy them.

I give up…

Meanwhile… back in the UK – I did a video y’day explaining why Rishi Sunak would be mad to listen to Tory MPs telling him to balance the budget. Last thing the UK needs is austerity and tax hikes – and since the UK controls its own money, we can make as much money as we like… Please nip on to the Shard Website and give it a like…

************

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

… and that is only the first step …