“Floodgates Are Open” – German Banks Start Charging Retail Savers

It has been over 7 years since the European Central Bank’s key deposit facility rate was positive, and just a few weeks ago it was lowered to a record low of -50bps.

Source: Bloomberg

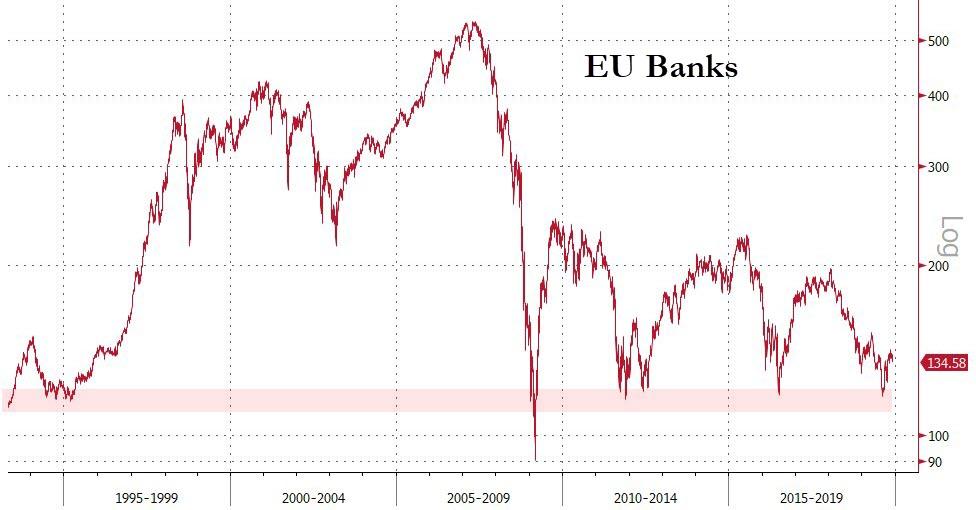

And during that time, European bank stocks have suffered greatly…

Source: Bloomberg

As Cornelius Riese, co-CEO of Frankfurt-based DZ Bank A.G. (Germany’s second-largest by assets), observed, negative rates indeed “have a huge impact on banks.” Riese ventured to offer some gentle criticism of Draghi & Co.’s grand policy experiment:

“Maybe at the end of the story, in three to five years, we will notice it was a historical mistake.”

Well, it appears we are about to reach the vinegar strokes of that ‘historical mistake’, as Bloomberg reports, German banks are breaking the last taboo: Charging retail clients for their savings, starting with very first euro in the their accounts.

While many banks have been passing on negative rates to clients for some time, they have typically only done so for deposits of 100,000 euros ($111,000) or more. That is changing, with one small lender, Volksbank Raiffeisenbank Fuerstenfeldbruck, a regional bank close to Munich, planning to impose a rate of minus 0.5% to all savings in certain new accounts.

Another bank, Kreissparkasse Stendal, in the east of the country, has a similar policy for clients who have no other relationship with the bank; and a third, Frankfurter Volksbank, one of the country’s largest cooperative lenders, is considering going even further and charging some new customers 0.55% for all their deposits.

“The floodgates are open,” said Friedrich Heinemann, who heads the department on Corporate Taxation and Public Finance at the ZEW economic research institute in Mannheim.

“We will soon see a chain reaction. Banks that do not follow with negative interest rates would be flooded with liquidity.”

It appears that European banks are coming around to the fact – and preparing for it – that negative rates are here to stay (especially under Lagarde who has already opined that there is nothing wrong with negative rates).

Bank CEOs across Europe have expressed their anger at the ECB’s policy over the last few months.

The ECB’s imposition of negative interest rates have created an “absurd situation” in which banks don’t want to hold deposits, rages UBS CEO Sergio Ermotti, arguing that this policy is hurting social systems and savings rates.

Oswald Gruebel, who served as Credit Suisse CEO from 2004 to 2007 and as UBS Group AG’s top executive from 2009 to 2011, has slammed ECB policy in an interview with Swiss newspaper NZZ am Sonntag.

“Negative interest rates are crazy. That means money is not worth anything anymore,” Gruebel exclaimed.

“As long as we have negative interest rates, the financial industry will continue to shrink.”

And finally, Deutsche Bank CEO Christian Sewing warned that more monetary easing by the ECB, as widely expected next week, will have “grave side effects” for a region that has already lived with negative interest rates for half a decade.

“In the long run, negative rates ruin the financial system.”

The German savings rate was around 10% in 2017, almost twice the euro-area average, but one wonders what will happen now that even mom-and-pop will have to pay to leave their spare cash in ‘safe-keeping’. Will deposit levels tumble in favor of the mattress? Or, as some have suggested, gold will get a bid as a costless way of storing wealth.

************

Original article

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.