ER Editor: A declining euro will certainly make those already expensive US LNG purchases even more expensive. Bravo, EU!

********

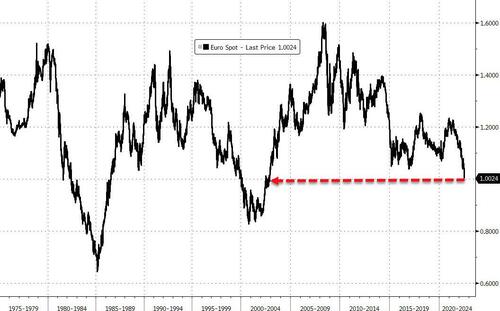

Euro Tumbles To Dollar Parity For First Time Since 2002

The Euro is trading at parity with the US Dollar. Having tested lower on Monday and then rebounded (on the back of USD selling/Gold buying), the euro has slid once again overnight…

This is the weakest the euro has been relative to the USDollar since Nov 2002 (note the chart below is adjusted for the DM prior to the formation of the euro)…

“The USD is carrying a lot of momentum right now and it’s hard to argue against owing the USD with such an aggressive Fed posture and the myriad of issues in Europe,” said Brad Bechtel, foreign-exchange strategist at Jefferies LLC.

“Having said that it feels like EUR/USD is oversold on many technical measures and parity was such a target for so many people in the market that it wouldn’t surprise if we see a lot of profit taking down here and a short term bounce.”

The weakness of the single currency reflects concerns over European gas supplies from Russia and an economic slowdown.

“The worst case (total stop of gas flows) brings recession and probably another 10% fall by the euro from here,” Societe Generale chief FX strategist Kit Juckes wrote in a note.

If EU NatGas prices are a proxy for this ‘worst case scenario’, then the euro has further to fall…

A string of increasingly-large Fed rate hikes has supercharged the dollar, while Russia’s invasion of Ukraine has worsened the outlook for growth in the eurozone and pushed up the cost of its energy imports.

Rate-hike differentials suggest the euro has further to fall…

ECB Governing Council member Robert Holzmann said Friday that the central bank should increase interest rates by as much as 125bps by September if the inflation outlook doesn’t improve. That would be a dramatic shock given the market is expecting around 75bps of hikes by then (and some have been jawboning the usual dovish sentiment as spreads defragment and stocks stall).

************

Source

Featured image: https://www.cmcmarkets.com/fr-fr/actualites-et-analyses/3-minutes-pour-decouvrir-et-comprendre-le-carry-trade

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.