German Government Bails Out Uniper From Energy Crisis

German energy giant and distressed natural gas utility Uniper, which is among the companies heavily exposed to Russian NatGas, secured a bailout with the German government, reported Bloomberg.

Bailout terms call for state-owned lender KfW to receive a 30% stake in Uniper for 267 million euros with further capital up to 7.7 billion euros against the issuance of mandatory convertible instruments. KfW will provide an expanded credit line of 9 billion euros from 2 billion euros.

The German government will introduce a cost absorption mechanism, covering 90% of all losses resulting from Uniper’s losses resulting from skyrocketing cost of NatGas purchases as Nordstream flows were reduced.

Fortum Oyj, Uniper’s top shareholder, will maintain a majority stake but will be diluted to 56% from 80%. Fortum’s President and CEO Markus Rauramo released this statement about the bailout and ongoing energy crisis in Germany.

“We are living through an unprecedented energy crisis that requires robust measures. After intensive but constructive negotiations, we found a solution that in an acceptable way met the interest of all parties involved.

“We were driven by urgency and the need to protect Europe’s security of supply in a time of war.”

Uniper shares surged as much as 7% after Bloomberg reported the deal was in the final stage earlier this morning but have since reversed and are down 16%. Shares of the utility have plunged more than 78% this year, valuing the company at 3.2 billion euros.

Uniper was hemorrhaging cash and had already drawn a 2 billion-euro credit line from KfW as talks about a bailout were first reported earlier this month. The utility had only received a fraction of its contracted NatGas volumes from Russian NatGas supplier Gazprom, forcing it to buy NatGas in higher spot markets — this is the issue that led to its demise. Explained below:

One number to consider. Uniper probably is paying currently ~€30 million extra for the gas it’s buying in the spot market. Multiply that for 365 days: ~€11 billion. And that’s one single European utility. Now think about other big buyers of Russian gas. And start multiplying. https://t.co/6hKzinI7Pw

— Javier Blas (@JavierBlas) June 30, 2022

Germany couldn’t let Uniper collapse as the fallout would roil the economy, already sliding into recession. Economy Minister Robert Habeck recently warned German’s energy crisis was at risk of a Lehman Brothers-like contagion.

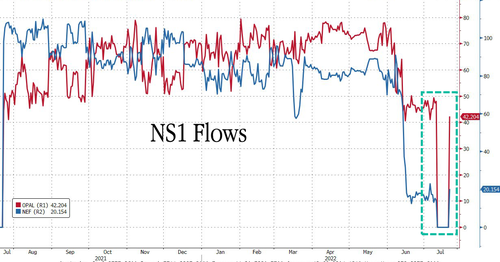

While flows through the Nord Stream 1 pipeline resumed Thursday after 10-day maintenance, deliveries remain down around 40% capacity, and injections into storage for winter were around 65% full.

The move by the government to bailout Uniper will thwart economic turmoil by saving the utility and allow it to continue to purchase NatGas, even at a loss, to ensure the storage target of 90% is reached by November.

************

Source

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.