ER Editor: Remember, economics are not what we’re supposed to be talking about, anywhere. For most of a decade, since the financial collapse of 2008/2009, it’s been a forbidden topic, which is hardly surprising since the financial elite doing the robbing of us also own the MSM and select our presidents and PMs.

While Hellevig has chosen to write about America for this article, a similar phenomenon is going on in other developed western countries, hence the Yellow Vest phenomenon in France.

********

Capitalism in America: How a Dismal Decimal is Robbing Americans Blind

31 Facts Showing How the Rich are Getting Richer and Everybody Else Poorer

JON HELLEVIG

For The Saker Blog

There is no hiding anymore: the United States has become an oligarch-owned banana republic with nukes, and with a monopoly currency which has allowed it to rig the markets for half a century. But now we are only a couple of hours from curtain – Midnight in America.

With the stock market at all-time highs, virtually no unemployment (or so they say), and brisk GDP growth (supposedly) in the last decade, economic analysts would declare that the US economy is in excellent shape. But it isn’t. The stock market is a central bank inflated asset bubble, and what GDP growth there has been is an illusion brought about by the very same financial bubble and by pumping the economy up with record federal borrowings to finance the deficits that America cannot afford. Rigged statistics showing artificially low inflation serve to hold together the Trumped-up American economic narrative. (About the rigged inflation statistics, see this report https://www.awaragroup.com/blog/the-inflation-measurement-scam/?fbclid=IwAR0qmpe4i0sp5Uce9UlyEDt0_NkIv-aiDTSgvzHh5EMfZn5WQboZz_mB-XU). And the low unemployment figure is nothing but a chimera based on misleading statistics.

In reality, the US economy is failing – and the country with it. At least two-thirds of the population has seen dramatic declines in living standards and half are back to levels of developing nations – without the development.

The big story covered up by all the happy macroeconomic figures repeated by rote by the US establishment – everybody from the president to cable television pundits and Trump fanboys – is the gradual impoverishment of the American worker. That’s an inconvenient truth increasingly difficult to hide as the American dream has turned into a nightmare for huge swathes of the population. As the figures we present below show, the rich are really getting richer, the middle class has been decimated, and half of Americans are poor and destitute of any financial wealth. The super-rich are gobbling up an ever-increasing slice of the American pie at the cost of all the rest who get nothing but table scraps on one side and leftover crumbs on the other, if anything. The resulting stratification of society has brought back a medieval servant economy, where the have-nots are doing odd jobs, cleaning houses, fetching groceries, running errands and deliveries for the feudal rich and the remaining shrinking middle class.

Thanks to the Fed (the American oligarch owned central bank) pushing easy money into the hands of the privileged elite, the super-rich Dismal Decimal – the top 0.1% – have by now amassed as much wealth as they had just before the Great Depression that started with the stock market crash in 1929. A lesson not learned. Back to square one. How will it end this time?

This article is based on an Awara Accounting https://www.awaragroup.com/ study titled “Widening Income and Wealth Gap and Stagnating Wages in America.” https://www.awaragroup.com/blog/widening-income-and-wealth-gap-and-stagnating-wages-in-america/ Links and source references to all the facts presented here can be found in said study.

BTW, all the data in this report is derived from official US government sources and American experts analyzing them.

During the last decades, the financial rewards from the rigged markets first flew exclusively into the pockets of the Top 10%, but later it was increasingly the Top 1%, which pocketed most, perfectly illustrated by the charts below.

1. The income of the Top 1% has grown five times as fast as that of Bottom 90% income since 1970, who now earn double the amount of income than 160 million poor of the lower 50% stratum.

The fortunes of the Top 1% and Bottom 50% are now reversed.

2. The Top 1% now holds as much wealth as the Bottom 50% combined.

Income inequality obviously leads to wealth inequality, but here the figures are yet more striking in showing the magnitudes of the grab at the top. Since 1989, the the Top 1% captured $21 trillion in wealth, while Bottom 50% lost $900 billion, actually pushing them down to negative wealth, meaning they have more debt than they have assets. On a net analysis, half of Americans own nothing of real value.

3.  Until the creeping coup under Reagan (ER: and Thatcher in the UK), income equality was improving

Until the creeping coup under Reagan (ER: and Thatcher in the UK), income equality was improving

It was bad enough in 1995 when the Top 1% earned as much as the Bottom 50%, but today the richest 1% already take 20% of all income, leaving the bottom half with only 12%. As the chart shows, back in 1978 – before the neoliberal creeping coup really got going – the trends were reversed. Below, the chart compares income growth since 1920 of the Top 1% to the Bottom 90% (that is, all the rest except the Top 10%). We see that right after Ronald Reagan entered the presidency with his Chicago School snake oil-influenced backers, the income growth of the 1% started its dizzying growth, which is continuing to this date.

4. Back in 1962, the share of the Top 1% of America’s wealth at 33% was equal to that of the Bottom 90%, but in the early 1980s, the share of the Bottom 90% started a steep descent and by 2016, their share had dwindled down to 21%. Especially after the Federal Reserve shifted its market rigging, low-interest-rate, money-pumping policy into high gear from the beginning of the 2000s, the super rich have experienced a massive rise in their fortunes, as illustrated by below chart.

But by today, the Top 1% are losers compared with the Top 0.1% – the Dismal Decimal – who are where the music plays.

5. The Top 0.1% now holds as much wealth as the Bottom 90% combined.

A recent study revealed that the concentration on the top is yet much more pernicious. It’s not any more a question of the Top 10%, and not even the Top 1%, as it is the Top 0.1% – the Dismal Decimal – that has now concentrated the wealth of the nation (and half the world) in their greedy hands. The Top 0.1% now holds as much wealth as Bottom 90% combined. As the chart below shows, we are essentially back to the Roaring Twenties…a lesson not learned. Actually, in the aftermath of the Great Depression, America entered an unprecedented era of four decades of prosperity with a more equal distribution of wealth as the Bottom 90% recovered strongly in distribution of wealth at the expense of the Top 0.1% parasites.

6. Top 0.1% earnings grew 347% between 1979 and 2017, while the Top 1% “only” gained 157% – the rest gained nothing

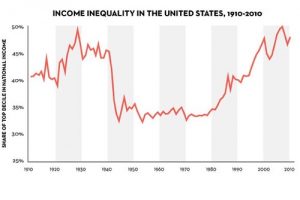

7. The next chart takes a longer perspective – while widening the sample to the Top 10% – and shows their share of the total income since 1910 to 2010. The Roaring Twenties – the period before the 1929 stock market crash and the ensuing Great Depression – experienced the same level of glaring inequality as today’s America. With Franklin D. Roosevelt’s reforms, the egregious average income inequality was tamed and stayed relatively low until Reagan’s fatal presidency. And it’s been downhill ever since – or uphill, if we look at it from the perspective of the rich.

8. The only economic figure that has managed to look good is the GDP, but that is so only until you bother to find out where it comes from – from the Federal Reserved-fueled asset bubble and massive federal budget deficits financed by record national debts. For an excellent exposé of how rigged and debt-ridden the US economy is, I refer to my earlier report published on the Saker blog: The Oligarch Takeover of US Pharma and Healthcare – And the Resulting Human Crisis. https://thesaker.is/the-oligarch-takeover-of-us-pharma-and-healthcare-and-the-resulting-human-crisis/ Shortly: The US economy must be seen as a giant Ponzi scheme, which will implode sooner or later. And we are getting to that sooner part now.

Trump habitually and regularly brags about the stock market reaching another all-time high. But that’s really being out of touch with the electorate. Stock market gains exclusively flow to the rich, increasing inequality and the cost of living for the rest. The thing is that, beyond the richest 10%, very few Americans have a stake in the stock market. In 2016, the richest one percent held more than half of all outstanding stock, financial securities, and all other sorts of equity. The remainder of those asset categories were held by the rest of the Top 10%, who owned over 93% of all stock and mutual fund ownership. What wealth the remaining 90% may own is largely residential housing, the homes where they live. According to Jonathan Tepper, the wealthiest 1% own nearly 50% of stock and the top 10% more than 81%. The so-called middle class owns only 8% of all stock.

This also kills the myth that record highs on the stock market would be good for American retirement savings – with the richest few holding all the shares, there’s nothing in it for the overwhelming majority.

A recent report also showed that only 10% of Americans are invested in pension plans. That is down from 60% in 1980. And those who are, are traditionally more weighted towards bonds and money-market instruments, which suffer from the rigged markets with the artificially low interest rates. The pension savers are hence literally paying for the super gains flowing into the pockets of Top 1%. On the other hand, the super low interest rates are out of grasp for the all but the Top 1%, who gobble up the wealth of the nation with that largesse delivered to them by their Federal Reserve. At the same time, the common household is paying double-digit rates on their credit card debt traps.

9. Below the Top 10%, wages and total household income have been stagnant, at best.

10. Average income of the Bottom 50% has stagnated at around $16,000 since 1980, while the income of the Top 1% has skyrocketed by 300% to approximately $1,340,000 in 2014.

11. 45% of Americans earn annually only 18,000 or less. A recent study found that 53 million Americans or 44% of the working age population earn a median average annual salary of only $18,000. Basically then, at least half of the Americans are working-poor.

12. Middle-class households had in 2015 basically the same income as they had in 1979.

13. In the two decades from 1997 to 2017, only the Top 5% of households saw their income increase

14. For most American workers, real wages have barely budged in decades. By end of 2018, the real inflation-adjusted average wage had about the same purchasing power it did 40 years ago.

15. As the below chart illustrates, the real average hourly wage, which was $20.27 in 1964, had only inched up to $22.27. David Stockman calculated that the real hourly worker’s wage was, in 2019, still at 1972 levels.

16. For full-time employed men, real wages have fallen 4.4% since 1973, according to economist Paul Craig Roberts.

The total average income of men, at $51,212 in 2015, was lower in real terms than it had been in 1974.

17. As of 2014, the average hours worked per week had fallen from around 39 hours in 1970s to under 34 hours. Economist Mike Shedlock calculated that the actual hours worked and the average hourly earnings would deliver a weekly income of $690, well below its $825 peak back in the early 1970s. If we multiply the hypothetical weekly earnings by 50, we get an annual figure of $35,497. That would in 2014 have translated to a 16.4% decline from its peak in October 1972.

18. All labor productivity growth since the 1970s has gone to the robber capitalists. From 1973 to 2013, hourly compensation of a typical (production/nonsupervisory) worker rose just 9% while productivity increased 74%.

19. Nowhere is income inequality and the egregious worsening trend as manifest as in the case of CEO pay. In the 1970s, CEOs made 30 times what typical workers made, but by 2017 the CEOs made 361 times the workers’ pay. According to the Economic Policy Institute, CEO compensation has grown 940% since 1978, while typical worker compensation has risen only 12% during that time.

The Fed-fueled financial market orgy is the main cause for the windfall riches of CEOs, as stock options and the accompanying share buybacks make up a huge part of CEO pay packages. This rising pay of executives was the main factor in the Top 0.1%’s super grab of household income

20. A 2017 study found that 40% of US adults struggle to pay for basic necessities like food, healthcare, housing, and utilities.

21. Most Americans have depleted all their spare resources, as a staggering 78% of full-time workers are reported to live from paycheck to paycheck.

22. Nearly 70% of Americans have virtually no savings. The Bottom 55% have zero savings, while the following 24% – the core of the former middle class – have only $1,000 stashed away.

23. Correspondingly, the Bottom 70% of Americans don’t own any real wealth (beyond rapidly depreciating durables).

24. The other side of the (non-existent) coin is that the same 50% of Americans would obviously struggle to come up with $400 for an unexpected expense. By extension, the former middle class – those with the miserly savings of $1,000 – would also have real trouble in coping with any kind of bill for medical treatment without getting into more debt. Considering the above reported findings (see the chart), only the Top 10% would be financially secure in a medical emergency.

25. According to shocking findings by the American Cancer Society, 137.1 million US residents suffered medical financial hardship in 2018. Americans had to resort to borrowing a total of $88 billion in 2018 only to cover essential medical treatment.

26. A third of young adults, or 24 million of those aged 18 to 34, live in their parents’ home because they cannot afford a home of their own.

27. The income and wealth gap pictures get worse yet when we look at the age distribution of wealth. Younger generations are earning less and own next to nothing (that is, if you are not the golden youth of the 10%). Baby Boomers born between the end of the Second World War and 1964 currently hold wealth that is 11 times higher than that of millennials.

Median Income for Younger and Older Families in Inflation-Adjusted Dollars

28. The number of full-time jobs with life-sustaining wages – what economist David Stockman calls breadwinner jobs – have not been growing since 2000; by 2014, their number was still 3.5 million or 5% lower than it was at the peak in early 2001. In the same period, 4 million part-time and gig jobs were created.

While the official unemployment figure is presently near historical lows – and at levels that some economists would like to call full employment – there are some big problems with it. 1. Problems with the official unemployment statistics. The officially touted unemployment figures (so-called U3 unemployment) record only those who have been looking for a job during the last 4 weeks, while discouraged long-term unemployed are cleansed from the statistics and left unrecorded as if they would not be in the workforce at all – makes stats look beautiful for the powers that shouldn’t be. 2. The labor participation rate has been falling. 3. New job creation has amounted to only a third of the annual increase in working age population. 4. Part-time and gig jobs count as full-time employment. Any person who takes a part-time or gig job for just a few hours a month is recorded among the employed, although they would rightly be considered unemployed merely clutching at straws. 5. Connected with the previous point, there is also a more general problem with the quality of jobs created. Most jobs created in the last two decades are low-paid, low-skill jobs that do not provide a life-sustaining income considering the cost of living in the United States.

More than one third (36%) of U.S. workers are in the gig economy, doing part-time work or side hustles for companies like Uber, Lyft, Etsy, Amazon Mechanical Turk, Freelancer.com, Ebay or just any odd job they can get from time to time.

29. To make up for the shrinking earnings, the regime is pushing the American population into 21st century debt peonage. Ensnared in the debt trap, US households had nearly $14 trillion in outstanding debt at the end of the third quarter 2019. That debt load now equals 73% of GDP. By the end of 2019, consumption debt alone (not including asset-acquiring mortgages) was up by $2 trillion since 2014.

Since 2004, the weight of the student loan millstone has gone up fivefold, from only $250 billion to today’s $1.5 trillion.

That’s due to the huge price inflation in higher education. The cost of both public and private college escalated by 40% over the general consumer price inflation between 2005 and 2015.

30. Because of the huge rise in the last few decades in cost of living in the US, in Russia, you get the same standard of living for a fraction of the American cost. A Moscow average monthly salary equal to $1,600 (annual $19,200) gives the same purchasing power as a monthly salary of $6,000 in Chicago (annual $72,000). Meaning, you live in Moscow at least as well for a monthly paycheck of $1,600 as you live in Chicago for a paycheck of $6,000. For details, see this report. https://www.awaragroup.com/blog/russia-vs-america-real-income-comparison/?fbclid=IwAR0pHruMMOgILt5w70ybE3oP9EmjKzVYfQF6sB_QepGixe1aIVqlvsyZGk4

31. The present oligarch-controlled, rigged, crony capitalist system has killed the American dream – the belief that anyone, regardless of parents’ social status and incomes, can attain success and wealth by hard work and ingenuity. The gates for upward mobility have been shut for the overwhelming majority. The monopolization of practically all sectors of the economy, the ever increasing bureaucratic restrictions on doing business, the extreme concentration of ownership, and the rigged financial markets have made it increasingly hard for people outside the top echelon of penetrating the financial membrane protecting the elites. A 2017 study by the Federal Reserve Bank of Cleveland found that the probability that a household outside the top 10% made it into the highest tier within 10 years was twice as high during 1984-1994 as it was during 2003-2013.

The United States is an oligarchy

This concentration of the income and wealth at the top proves that the United States is an oligarchy. A 2014, study by Princeton University https://www.businessinsider.com/major-study-finds-that-the-us-is-an-oligarchy-2014-4 demonstrated how the US is a political oligarchy. With this report showing the insanely widening income and wealth inequality, my aim is to show that the country is an economic oligarchy, too. In fact, economic super riches are the precondition for their political power, too. In America, as always, the oligarchy has achieved their uncontested power in a hermeneutical feedback loop, where the initial wealth of the superrich has bought them increased political power, which has given them increased riches, which has bought them more political power, and so on, until today, when they own practically the whole economy and the entire government. Clearly the source of higher inequality has been Fed policies, which has pushed cheap money into the pockets of the already rich, who have exclusively then benefited from soaring stock and real estate prices.

Fittingly, we got at the end of 2019 a report revealing that the world’s richest people increased their wealth in the year by $1.2 trillion, a staggering 25%, most of which belong to the oligarchs of the United States.

The question – which I have set to explore in my series, Capitalism in America – is whether there has been a game plan, a long-term strategy or whether intermittent achievements have just spurred the oligarchs on to new economic and political power grabs in the course of establishing their totalitarian rule. I tend to think there has been a long-term plan ever since the establishment of the Federal Reserve. The economic and political history of the United States provide so much circumstantial evidence, which supports the view that there has been a conspiracy of the Wall Street elite. I shall return to this hypothesis in further installments to this series, Capitalism in America. It is, however, clear – whether through a long-term plan or by a series of ad hoc interventions – the US financial elite has by now completed a creeping coup, which has delivered them absolute economic and political power.

In my investigation of the oligarchization of America – the creeping neoliberal oligarch coup, which was set in full force since Reagan – I have so far completed these instalments:

The first installment was a study showing how all corporate ownership has been concentrated in the hands of the oligarchy, titled Extreme concentration of ownership in the United States http://blogengine.hellevig.net/post/2019/05/13/Extreme-concentration-of-ownership-in-the-United-States-.aspx

The second part was a study revealing how the oligarchy has totally taken over US media, titled The Oligarch Takeover of US Media http://blogengine.hellevig.net/post/2019/05/13/The-oligarchy-wields-totalitarian-control-over-the-media-through-just-a-few-corporations.aspx

The third installment was a report published on the Saker blog titled New World Order in Meltdown, But Russia Stronger Than Ever https://thesaker.is/new-world-order-in-meltdown-but-russia-stronger-than-ever/

The fourth installment, The Oligarch Takeover of US Pharma and Healthcare https://thesaker.is/the-oligarch-takeover-of-us-pharma-and-healthcare-and-the-resulting-human-crisis/ was also on the Saker blog.

Next up is a report showing how, from the point of view of political science, the oligarchy has destroyed the social fabric of the US economy and deliberately enacted laws that favor the few over the people. Of particular interest here is how the oligarchy has rigged the political system by institutionally solidifying the mendacious Janus-faced two-party system in order to remove any potential challenge to their rule.

************

Original article

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.