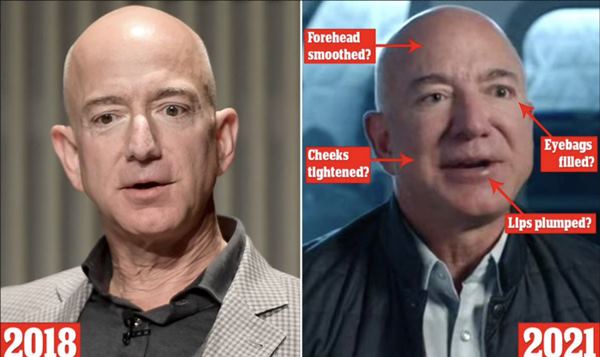

ER Editor: A reminder that Bezos, for example, has had a double (or triple – check the three different men in this article) functioning out there in a very obvious way and for quite some time. We doubt that this selling off of shares is a real event, but one cooked up as a comm. Five days prior to the announcement of Jacob Rothschild’s passing, who was probably long gone anyway. We believe there is heavy symbolism being communicated.

A reminder that Trump passed many Executive Orders, (some of) which have been renewed under the ‘Biden’ regime. One of those, and we apologize for forgetting which one, permits the seizure of assets dependent upon certain types of crime being committed, seized in the interest of US national security. By now, we don’t imagine for a moment that any of these figures or families are selling to generate wealth for themselves. They are likely not at liberty.

Cesare Sacchetti’s reading below (a journalist we highly recommend) takes the rational approach of seeing these people as free agents, making rational decisions in the face of declining global finance based on fiat currency.

***

There’s Walmart, too, and Gates and Buffet —

🚨JUST IN: Walton family sells +$1.5 billion of Walmart stock

The family owns about 45% of Walmarts outstanding shares through the trust and their main investment vehicle

This is just a small trim of their overall position!

Noteworthy that – Bezos, Zuckerberg, Dimon, Gates -… pic.twitter.com/bMSwVxQpqt

— Genevieve Roch-Decter, CFA (@GRDecter) February 26, 2024

Recently we’ve seen:

Jeff Bezos sold $8.5B of Amazon stock

Jamie Dimon sold $150M of JPMorgan

Mark Zuckerberg sold $400M of Meta

Walton family sold $4.5B of Walmart last year

& Warren Buffet has been selling, having the most cash on hand last quarter than he’s ever had.Do…

— Truth doesn’t mind being questioned. (@shouldveknown11) February 25, 2024

********

Zuckerberg, Bezos and Dimon are selling their shares: is the definitive collapse of Wall Street and globalization coming?

CESARE SACCHETTI

The first to sell his shares was the owner of Amazon, Jeff Bezos, who in an unprecedented move sold shares of his company for a total value of 8.5 billion dollars.

Those who follow financial events carefully probably already know that the American giant of global destruction is not doing well at all after the end of the pandemic farce.

In fact, after 2022, its value has literally halved, going from the previous 1.7 trillion dollars to falling to 800 billion at the end of 2022.

Amazon is going through a deep and temporary crisis which is also leading it to reduce its staff around the world.

Following Amazon was an exponent of what in the United States is called Big Tech, or the technological sector that dominates the internet, and the person in question is none other than Mark Zuckerberg, founder of Facebook, who started selling 428 million dollars of the shares of his social network, now renamed with the name Meta, as early as the end of 2023.

To complete the series of leading names in the world economy, another heavyweight in the world of international finance arrived, Jamie Dimon, CEO of the famous, or perhaps we should say infamous, investment bank JP Morgan, which sold the shares of his bank worth approximately $150 million.

JP Morgan is probably already known to several readers. This bank was one of the protagonists of the looting of Italian state companies in 1992 on board Queen Elizabeth’s yacht Britannia.

Acting as master of ceremonies for the sale of what was the heritage of all Italians was, as is known, the young Mario Draghi in the role of director of the Treasury, who on board the Britannia decided to liquidate an immense treasure at sale prices at Anglo-Saxon speculative finance.

Even today, it is not clear who authorized Draghi to commit that act of betrayal towards the State when, on the night of the sale, 2 June 1992, there was not yet a government in office with full powers as the government Andreotti had fallen and government activities could not go beyond the threshold of handling current affairs.

Only about a month later another government was formed, that of Amato, who promptly ratified the sell-off, but not before having stolen Italians’ money overnight through the infamous withdrawal from bank accounts.

The flight of the market lords is unprecedented

Now some might think that what is happening is ordinary administration as regards the trading of shares, but in reality this is not the case at all.

Just think of the previously mentioned case of Jamie Dimon. Dimon has not sat in the chair of CEO of JP Morgan for a day.

He has held this position since 2006, shortly before the famous subprime mortgage crisis broke out, to which the New York bank then offered its indispensable contribution.

Not even at the dawn of such a serious crisis did Dimon get rid of such a large number of shares despite knowing perfectly well that the real estate bubble created by the markets in the early 2000s would sooner or later inevitably explode.

At the time, however, Wall Street did not appear the least bit worried. In the White House there was a president who had been financed and supported by them, namely the neocon Republican, George W. Bush, firmly in the hands of the Zionist lobby.

Bush authorized a program called the Troubled Asset Relief Program, which means support program for businesses in difficulty.

At least 700 billion dollars were allocated to rescue banks such as JP Morgan, Goldman Sachs and Bank of America, and in the following years Bush’s successor, Democrat Barack Obama, authorized the continuation of the financial rescue.

Those who had dragged America and the entire world into the biggest financial crisis after 1929 were once again saved by the rigged slot machine of the American central bank, namely the Federal Reserve Bank (FED).

The history of the FED was told by the American researcher Eustace Mullins who explained how in 1913 President Wilson authorized the establishment of a central bank which was not owned by the American government but which was actually under the control of powerful private banking groups such as those of the Morgan family, the Rockefellers and the Rothschilds.

When the aforementioned mortgage crisis broke out, Jamie Dimon was on the board of directors of one of the 12 banks that controls the Fed, in this case the New York section of the Federal Reserve.

If you look at the board of directors of this bank you will discover that Rajiv J. Shah, economist and president of the Rockefeller Foundation, is also currently a member .

The conclusion can therefore only be obvious. The architects of the bankruptcy used the central bank, which has the power to create money out of thin air, to save themselves and did not use the leverage of the FED instead to support the real economy.

The philosophy of neoliberal Protestantism can be seen perfectly in what happened then and on several other occasions.

The State is banned and its power of monetary intervention must not be used to support small and medium-sized businesses and savers but the oligarchs who are the absolute masters of the liberal system.

They are the true State. This time, however, we are in the presence of a new phenomenon. The top members of New York’s speculative finance industry make decisions that, as we have seen, are unprecedented in this regard.

Does Wall Street know that globalization and its dominance is over?

The inkling that something new was happening in the United States had already been felt when some large American banks began to fail in California, where many people from the world of entertainment and politics deposited their assets. (ER: Were these two classes of people being targeted financially?)

This time around, the FED hasn’t lifted a finger. The protégés of finance begin to lose their money and the machine that saved them 16 years earlier is not started. (ER: We’re not certain the Fed exists anymore.)

Even with regards to the more specifically political objectives of these financial groups, we are starting to see a clear change of direction.

Last week again JP Morgan, joined on this occasion by BlackRock, decided to abandon their investments in the United Nations climate program based on the well-known global warming hoax.

These are the policies so dear to Davos who in their annual meetings dreamed of a world with zero emissions, where the real ultimate goal is certainly not to protect the environment, which does not suffer from a real entropic threat, but rather that of accompanying the world towards mass deindustrialization, prodromal to the depopulation that these globalist Malthusian circles so desire.

When Massimo D’Alema some time ago said, not too joyfully for him, that globalization had come to an end, he was certainly right.

The season of the 90s is fortunately coming to an end. The time of wild relocations and the explosion of international trade to the detriment of national production is over.

Just as the engine of globalisation, China, has already started to slow down for some time after its divorce with Anglo-Saxon finance, without which the Chinese dragon would never have been able to reach its position of absolute dominance on the markets.

If globalization has therefore reached its final phase, this inevitably implies a loss of the enormous power that the oligarchs had accumulated.

Globalization is nothing other than the ferocious financial face of globalism. Globalism wanted the creation of an empire through the birth of global governance where states would then completely lose their residual powers and the “large” financial and industrial groups would have had an even more dominant position than that of the last 30 years.

It would have been a situation where the inequalities between social classes would have been even wider than those paradoxically existing in the times in which slavery existed.

The power that the globocrats would have had should have been immense and the end, or rather the failure, of this vision instead caused the reverse process.

This is the reason why we are starting to see an escape from the markets of those who were the masters of globalization. (ER: There may be other reasons.)

They seem to know that this time there will not be the convenient parachute of the FED and there will not be the political support of a complacent presidential administration governed by them, especially given the absolute vacuum of power that exists in Washington with the Biden administration .

These escapes from the markets could be the signal of the definitive requiem of speculative finance and its predators. If in the last century finance was the power that had the life of states in its hands, the current and future phase will be based on the reverse process.

The end of globalization cannot fail to bring the end of the dictatorship of capital.

Source

************

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

Leave a Reply