UK workers’ wages slashed by as much as a third in last decade

BARRY MASON

The onslaught against workers’ wages since the 2008 financial crisis has resulted in pay falling by as much as a third in parts of Britain.

A report by the Trades Union Congress (TUC), based on figures from the Office for National Statistics, notes, “UK workers are suffering the longest real wage squeeze in more than 200 years, with average pay packets not set to recover to their 2008 level until 2024.”

Such is the collapse in wages that “The UK is only of two advanced economies (along with Italy) where real wages are still lower than a decade ago.”

Workers in London suffered the greatest loss in real wages over the decade—at £20,390—while the average real wage loss figure for the whole of the UK was £11,840.

Areas suffering the highest losses, with a loss of around a third in the value of real earnings, were the London borough of Redbridge and Epsom and Ewell in Surrey. In other areas, workers have lost a quarter in the value of real wages, including in the London borough of Barnet, Selby in East Yorkshire, Waverley in Surrey and Anglesey in north Wales. This figure matches the drop in Greece.

In the deindustrialised heartlands of the north west and Yorkshire and the Humber, wages fell cumulatively by £14,230 and £12,680. Commenting on the situation in the north west, the TUC  notes, “Real wages are still lower than a decade ago in 34 of the region’s 43 local authority areas. And only four areas have seen the value of wages increase by 5% or more since 2008.”

notes, “Real wages are still lower than a decade ago in 34 of the region’s 43 local authority areas. And only four areas have seen the value of wages increase by 5% or more since 2008.”

The TUC study follows an International Labour Organisation (ILO) report released November. It found that real wage growth of workers in the UK was among the weakest in the advanced economies of the G20 nations. According to the ILO, a recovery in real wage growth following the 2008 crash began in 2014 but hit a brick wall in 2016.

Despite government claims that wages are recovering, the prognosis for workers’ pay remains grim. This is reflected in the latest Earnings Outlook of the Resolution Foundation (RF). Nye Cominetti, economic analyst at the RF wrote, “[T]he longer-term [situation] is poor because productivity growth, a key driver of pay, remains weak. This was reflected in the OBR’s [Office of Budget Responsibility] recent pay projection, which, if correct, would mean real pay will not recover to its pre-recession peak until 2024. This would amount to a 17-year pay squeeze.”

Speaking in October, Bank of England chief economist Andy Haldane linked the decline in real wage growth with the rise of insecure work. He spoke of a “lost decade” for workers, with job insecurity increasing as the use of flexible contracts rose. Haldane quoted data from a survey showing that 1.7 million workers suffered anxiety because of uncertainty over the hours of work available. The use of zero-hour contracts has risen at least fivefold since the millennium. Currently, around 1.8 million contracts are for zero hours.

Attacks on jobs, wages and conditions have produced a huge growth in the numbers of working poor. The Joseph Rowntree charity’s annual report analysing in-work poverty noted:

“In our society there are now almost four million workers in poverty, a rise of over half a million compared with five years ago and the highest number on record. The employment rate is also at a record high, but this has not delivered lower poverty. Since 2004/05, the number of workers in poverty has increased at a faster rate than the total number of people in employment, resulting in workers being increasingly likely to find themselves in poverty.

Latterly the rise in in-work poverty has been driven almost entirely by the increase in the poverty rate of working parents, which has grown over the past five years. A working parent is now over one-and-a-half times more likely to be in poverty than a working non-parent.

Workers in four types of industry have particularly high rates of poverty: accommodation and food services (25 percent), agriculture, forestry and fishing (23 percent), administrative and support services (22 percent) and wholesale and retail (18 percent). This compares with a poverty rate for workers overall of 12 percent.”

It concluded that “in-work poverty is increasing faster than employment. Many workers are caught in the middle of a series of moving currents: stuck in low-paid work, with little chance of progression, subject to high housing costs and using a weakening social security.”

The National Education Union carried out a poll of more than 1,000 teachers to determine how the increase in poverty is affecting children and young people. As the report titled “Teachers witnessing distressing new levels of child poverty this winter in schools” noted, 46 percent of teachers confirm that holiday hunger has got worse compared to three years ago.

It also found that:

* 63 percent of respondents say that more families are unable to afford adequate winter clothes or shoes compared to three years ago.

* 46 percent of teachers believe that there are more housing issues (poor quality, insecure, overcrowded or temporary accommodation).

* 53 percent of respondents believe that children and young people will go hungry over Christmas.

* 40 percent of respondents say schools are having to provide extra items for children and young people and their families because of increased poverty.

The Young Women’s Trust was set up to support and represent women aged 16-30 struggling to live on low pay or no pay. Its report using data collected earlier in the year established:

* Four in 10 young women (40 percent) say it is a “real struggle” to make their cash last to the end of the month, compared to 29 percent of young men. This rises to 58 percent of women aged 25 to 30.

* 28 percent of young women and 21 percent of young men say that their financial situation has gotten worse in the last 12 months.

* 39 percent of young women have been offered a zero-hours contract, compared to 32 percent of young men. In 2017, the figure was 33 percent of young women.

* 27 percent of young women say their level of debt has gotten worse in the past year, and one in four say they are in debt “all of the time.”

* Just 5 percent of young women are currently debt-free, and 37 percent don’t think they will be debt-free by the age of 40.

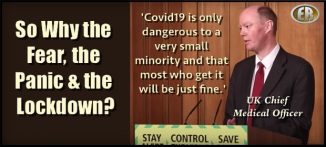

Those politically responsibility for this situation are the Labour Party and trade unions, with Labour councils having imposed central government cuts in the urban centres they run.

The collapse in wages reported on by the TUC is the severest indictment of its own role. It has sabotaged every single struggle of the working class over the decade it documents, from the fight against pension cuts by millions of workers in 2011, to the junior doctors’ strike against an inferior contract in 2016. This year alone, the unions have sold out struggles by university lecturers and administrators and rail workers. Earlier this year, 13 National Health Service unions agreed on a sellout deal that ensured that 1 million health workers—who had already suffered seven years of pay freezes reducing their pay by 14 percent—will continue to have their pay cut for another three years.

************

Original article

ER recommends other articles by WSWS