ER Editor: It’s 50 years on and we’re heading toward the Quantum Financial System finally, which is backed by traceable, surveilled gold, which will stop the madness and power grab described below. We’ll be keeping our eyes on this topic as more becomes revealed.

********

A Look Back At Nixon’s Infamous Monetary Decision

A half century ago one of the most disastrous monetary decisions in U.S. history was committed by Richard Nixon. In a television address, the president declared that the nation would no longer redeem internationally dollars for gold. Since the dollar was the world’s reserve currency, Nixon’s closing of the “Gold Window” put the world on an irredeemable paper monetary standard.

The ramifications of the act continue to this very day.

America’s current financial mess, budget deficits, the reoccurring booms and busts, the decline of living standards (particularly the middle class), all have their genesis with Nixon’s infamous decision in August, 1971.

Abandoning the last vestiges of the gold standard was the culmination of a long-term goal of the banksters, politicians, financial elites, and deceitful economists.

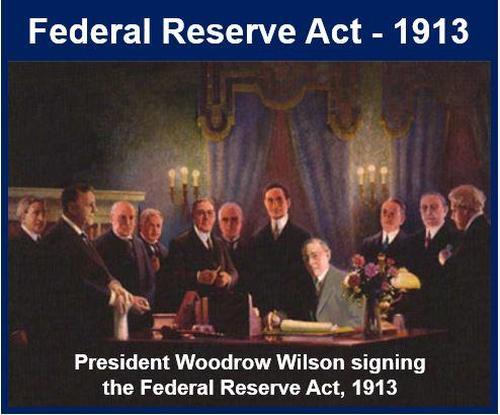

The first step was the establishment of the Federal Reserve in 1913 whose primary purpose was to allow its member banks to inflate the money supply without fearing the consequences – bank failures/panics, bank runs, recessions / depressions. The Fed could, and still does, through the control of the money supply enrich itself, the government (ER: The Fed is privately owned, it is not the government), and its aligned financial elites at the expense of the public at large.

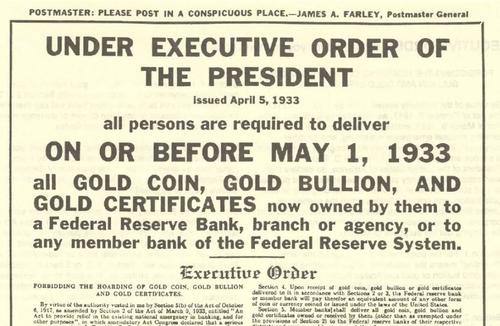

The next step on the road to monetary debasement was Franklin Roosevelt’s draconian measure of outlawing the private ownership of gold. This was not only an unprecedented and outrageous attack on private property, but it also eliminated gold redemption of dollars domestically, which gave the Fed unlimited power to print money without fear of its notes being redeemed.

The specious justification for the law, enacted shortly after the start of FDR’s first tyrannical term in office, was to fight the Great Depression. Of course, the measure did nothing to mitigate the Depression which, in fact, was not caused by Americans’ ownership of gold, but rather the Fed itself and its wild inflationary policies throughout the “Roaring 20s.”

FDR’s action, like Nixon’s, demonstrated how much the power of the presidency had expanded. It shows again the flawed and frankly naïve argument put forth by Constitutionalists and conservatives of every ideological persuasion that the celebrated “separation of powers” theory that supposedly checks the aggrandizement of federal power could not prevent the audacious acts of FDR and Nixon. Despite what is taught in social science courses, a true gold standard is a greater protector of individuals’ economic well being and, ultimately, their political liberty than any legislation, bills of rights, or constitution ever penned. Hard money limits state power!

The primary reason why President Nixon closed the Gold Window was to fund the nation’s “guns & butter” economic and social policies which had begun under his predecessor Lyndon Johnson. Johnson’s “War on Poverty” and his escalation of the war in Vietnam caused the Fed to print vast amounts of money, which began to drain the Treasury of gold.

While U.S. citizens and financial institutions could not redeem dollars for gold, foreign central banks could. The U.S.’s inflationary policy to fund its domestic and foreign objectives was why the Gold Window was closed. In effect, the U.S. was reneging on its commitment, which had been in place since Bretton Woods. It was not as President Nixon announced as part of his new economic policy initiative entitled “The Challenge of Peace,” “to take action necessary to defend the dollar against the speculators.”* Instead, it was the type of monetary chicanery that banana republic’s often pursue.

Culturally, the eradication of hard money was part of the transformation of a mature, frugal, hardworking, and future-oriented people into an infantile, self-absorbed, dysfunctional, and hedonistic collection of individuals. While many consequences of this change could be cited, one of the most telling is that America has gone from a creditor nation (in 1971) to a debtor nation within a couple of generations. Not only has the national debt exploded (which now exceeds $30 trillion!), but personal and corporate debt are at dizzying heights.

At this point, a reversal of President Nixon’s decision would do little to confront the immense problems which the U.S. economy faces. A “Great Reset” of the economic system is in order, but not the kind envisioned by the world’s financial elites.

An honest-to-goodness reset would begin with a return to a metallic monetary standard where all national currencies would be redeemable in gold/silver. Such a move would put a real check on banks’ ability to create money “out of thin air.”

The return of prosperity will only come about when gold is again a part of the monetary order and reasserts its critical role in the limitation of central bank power.

************

Source

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

Not quite. FDR took the US off the gold standard on June 5, 1933 – Nixon simply extended internationally what FDR had done internally.